Agentic Payment OS

Protocol for the emerging Agentic Economy

Global Infrastructure Connectivity Engine

Identity, Trust, and

the Personalization Engine

Access a variety of AI Agents for your everyday needs

Agent Creation

Easy AI Agent Creation Tools

APOS

Agentic Payment Operating System

DID

Decentralized Identity System with complete privacy and security

Decentralized Identity and Reputation System for AI Agents

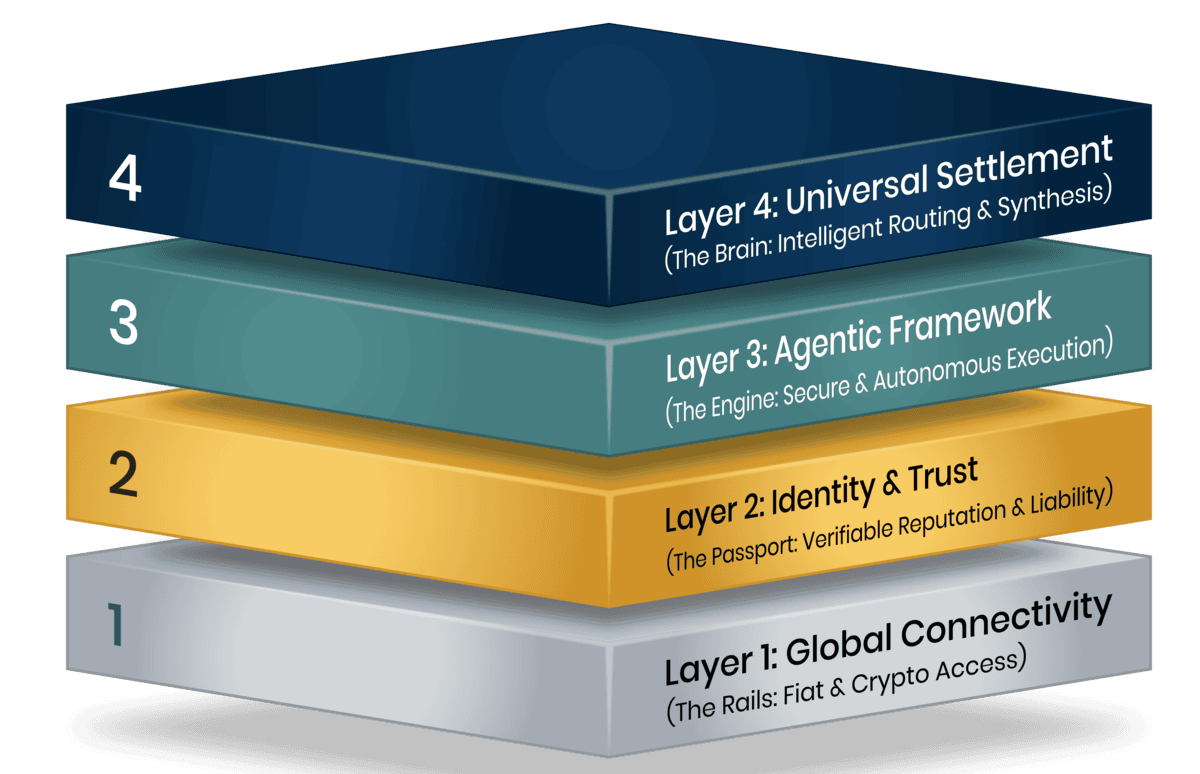

The Agentic Framework & Autonomy Engine

Universal Settlement & Orchestration Engine

Global Infrastructure Connectivity Engine

Identity, Trust, and

the Personalization Engine

DID

Decentralized Identity System with complete privacy and security

Decentralized Identity and Reputation System for AI Agents

APOS

Agentic Payment Operating System

Access a variety of AI Agents for your everyday needs

Agent Creation

Easy AI Agent Creation Tools

The Agentic Framework & Autonomy Engine

Universal Settlement & Orchestration Engine

Agentic Payment Operating System (APOS)

The AIOT Agentic Payment OS functions as a dedicated connectivity protocol designed to bridge the gap between legacy financial infrastructure and the demands of the emerging Agentic Economy.

AIOT employs a “Direct Facilitation” strategy through a four-layer stack:

APOS Integrations

Explore some of the essential integrations that power AIOT's Agentic Payments Operating System

x402

Enabling payment for resources via API without registration, emails, OAuth, or complex signatures using cryptocurrency

ACP Protocol

Enabling dialogue between buyers, their AI agents, and businesses to conduct purchases

ERC4337

Enabling account abstraction for improved user experience, account recovery, gasless transactions, and programmable permissions

ERC8004

On-chain audit trail to enable a verifiable reputation system and registry for AI Agents

A2A Protocol

Enabling seamless communication and collaboration between AI agents

Fiat Payment Rails

Seamless plugin with AIOT VISA Card to enable fiat settlement

AIOT Web3 Card

Sign up for AIOT physical or virtual card to easily spend your crypto and AIOT at over 100 million merchants throughout the world while earning rewards for spending.

Your AI journey in 3 steps

A simplified user experience to deliver instant improvements to your quality of life

Create an account

Sign up to access our website and app

Create your DID

Your DID (fully under your control) will serve as the key for portable personalization and unified context

Access AI Agents

Connect your DID to AI Agents to help you with your everyday tasks

Case Studies

Here are some examples of how AI Agents can help you save time and money

Case Study 1

Algorithmic Expense Optimization

Scenario :

- User pays $15/month for a streaming service they rarely use, and $50/month for a gym membership they visit daily.

Agent Action :

- The Agent accesses the DID-anchored Personalization Graph and identifies the inefficiency. It negotiates via A2A protocols to cancel the streaming service. Simultaneously, it finds a corporate discount for the gym via a partner API.

Execution :

- The agent uses the AIOT Virtual Card to pay the new, lower gym rate and leverages ERC-4337 batching to revoke the streaming subscription authorization.

Result :

Verified savings with zero user effort, optimized purely by code.

Case Study 2

Seamless Recurring Billing Automation

Scenario :

- Managing bill due dates creates cognitive load. A missed payment results in fees.

Agent Action :

- The Agent maps all utility and rent payments. It sets up Session Key Mandates for each vendor (e.g., "Landlord: Max $2000, Monthly").

Execution :

- On the due date, the Orchestration Layer checks the user's liquidity. If the user holds mostly ETH and the bill is in USD, the X402A layer auto-converts the necessary amount and routes the payment via the ACH rail (Layer 1).

Result :

Automated financial hygiene and elimination of late fees.

Case Study 3

Intelligent On-Demand Procurement

Scenario :

- User tells their device: "Order me a double cheeseburger with bacon, but make sure it's from a place with good hygiene ratings."

Agent Action :

- The Agent calculates the Net Present Value (NPV) of using points vs. cash for the specific flight. It identifies that using "Airline A Points" yields a value of 3 cents/point, whereas "Card B Points" yields only 1 cent/point.

Execution :

- The Agent executes the booking using the optimal mix of points and cash, routing the cash portion via the AIOT card to earn further rewards.

Result :

Frictionless procurement where the financial authorization is tightly coupled to the specific intent.

Case Study 4

Advanced Anomalous Consumption Detection (ACD)

Scenario :

- A traditional bank blocks a card because the user buys coffee in London and lunch in Paris on the same day.

Agent Action :

- A traditional bank blocks a card because the user buys coffee in London and lunch in Paris on the same day.

Execution :

- The transaction is validated instantly because the context explains the anomaly.

Result :

Non-disruptive security that adapts to the user's lifestyle rather than forcing the user to fit the bank's rigid models.

Case Study 5

Maximal Reward Application

Scenario :

- A user has points across three different airlines and two credit cards. They want to book a flight.

Agent Action :

- The Agent calculates the Net Present Value (NPV) of using points vs. cash for the specific flight. It identifies that using "Airline A Points" yields a value of 3 cents/point, whereas "Card B Points" yields only 1 cent/point.

Execution :

- The Agent executes the booking using the optimal mix of points and cash, routing the cash portion via the AIOT card to earn further rewards.

Result :

Maximize value capture on every transaction through computational arbitrage.

Case Study 1

Algorithmic Expense Optimization

Scenario :

- User pays $15/month for a streaming service they rarely use, and $50/month for a gym membership they visit daily.

Agent Action :

- The Agent accesses the DID-anchored Personalization Graph and identifies the inefficiency. It negotiates via A2A protocols to cancel the streaming service. Simultaneously, it finds a corporate discount for the gym via a partner API.

Execution :

- The agent uses the AIOT Virtual Card to pay the new, lower gym rate and leverages ERC-4337 batching to revoke the streaming subscription authorization.

Result :

Verified savings with zero user effort, optimized purely by code.

Case Study 2

Seamless Recurring Billing Automation

Scenario :

- Managing bill due dates creates cognitive load. A missed payment results in fees.

Agent Action :

- The Agent maps all utility and rent payments. It sets up Session Key Mandates for each vendor (e.g., "Landlord: Max $2000, Monthly").

Execution :

- On the due date, the Orchestration Layer checks the user's liquidity. If the user holds mostly ETH and the bill is in USD, the X402A layer auto-converts the necessary amount and routes the payment via the ACH rail (Layer 1).

Result :

Automated financial hygiene and elimination of late fees.

Case Study 3

Intelligent On-Demand Procurement

Scenario :

- User tells their device: "Order me a double cheeseburger with bacon, but make sure it's from a place with good hygiene ratings."

Agent Action :

- The Agent calculates the Net Present Value (NPV) of using points vs. cash for the specific flight. It identifies that using "Airline A Points" yields a value of 3 cents/point, whereas "Card B Points" yields only 1 cent/point.

Execution :

- The Agent executes the booking using the optimal mix of points and cash, routing the cash portion via the AIOT card to earn further rewards.

Result :

Frictionless procurement where the financial authorization is tightly coupled to the specific intent.

Case Study 4

Advanced Anomalous Consumption Detection (ACD)

Scenario :

- A traditional bank blocks a card because the user buys coffee in London and lunch in Paris on the same day.

Agent Action :

- A traditional bank blocks a card because the user buys coffee in London and lunch in Paris on the same day.

Execution :

- The transaction is validated instantly because the context explains the anomaly.

Result :

Non-disruptive security that adapts to the user's lifestyle rather than forcing the user to fit the bank's rigid models.

Case Study 5

Maximal Reward Application

Scenario :

- A user has points across three different airlines and two credit cards. They want to book a flight.

Agent Action :

- The Agent calculates the Net Present Value (NPV) of using points vs. cash for the specific flight. It identifies that using "Airline A Points" yields a value of 3 cents/point, whereas "Card B Points" yields only 1 cent/point.

Execution :

- The Agent executes the booking using the optimal mix of points and cash, routing the cash portion via the AIOT card to earn further rewards.

Result :

Maximize value capture on every transaction through computational arbitrage.

Case Study 1

Algorithmic Expense Optimization

Scenario :

- User pays $15/month for a streaming service they rarely use, and $50/month for a gym membership they visit daily.

Agent Action :

- The Agent accesses the DID-anchored Personalization Graph and identifies the inefficiency. It negotiates via A2A protocols to cancel the streaming service. Simultaneously, it finds a corporate discount for the gym via a partner API.

Execution :

- The agent uses the AIOT Virtual Card to pay the new, lower gym rate and leverages ERC-4337 batching to revoke the streaming subscription authorization.

Result :

Verified savings with zero user effort, optimized purely by code.

Case Study 2

Seamless Recurring Billing Automation

Scenario :

- Managing bill due dates creates cognitive load. A missed payment results in fees.

Agent Action :

- The Agent maps all utility and rent payments. It sets up Session Key Mandates for each vendor (e.g., "Landlord: Max $2000, Monthly").

Execution :

- On the due date, the Orchestration Layer checks the user's liquidity. If the user holds mostly ETH and the bill is in USD, the X402A layer auto-converts the necessary amount and routes the payment via the ACH rail (Layer 1).

Result :

Automated financial hygiene and elimination of late fees.

Case Study 3

Intelligent On-Demand Procurement

Scenario :

- User tells their device: "Order me a double cheeseburger with bacon, but make sure it's from a place with good hygiene ratings."

Agent Action :

- The Agent calculates the Net Present Value (NPV) of using points vs. cash for the specific flight. It identifies that using "Airline A Points" yields a value of 3 cents/point, whereas "Card B Points" yields only 1 cent/point.

Execution :

- The Agent executes the booking using the optimal mix of points and cash, routing the cash portion via the AIOT card to earn further rewards.

Result :

Frictionless procurement where the financial authorization is tightly coupled to the specific intent.

Case Study 4

Advanced Anomalous Consumption Detection (ACD)

Scenario :

- A traditional bank blocks a card because the user buys coffee in London and lunch in Paris on the same day.

Agent Action :

- A traditional bank blocks a card because the user buys coffee in London and lunch in Paris on the same day.

Execution :

- The transaction is validated instantly because the context explains the anomaly.

Result :

Non-disruptive security that adapts to the user's lifestyle rather than forcing the user to fit the bank's rigid models.

Case Study 5

Maximal Reward Application

Scenario :

- A user has points across three different airlines and two credit cards. They want to book a flight.

Agent Action :

- The Agent calculates the Net Present Value (NPV) of using points vs. cash for the specific flight. It identifies that using "Airline A Points" yields a value of 3 cents/point, whereas "Card B Points" yields only 1 cent/point.

Execution :

- The Agent executes the booking using the optimal mix of points and cash, routing the cash portion via the AIOT card to earn further rewards.

Result :

Maximize value capture on every transaction through computational arbitrage.

Frequently Asked Questions

Everything You Need to Know Before You Start.

AIOT DID (Decentralized Identifier) is a unique, self-sovereign digital identity that gives you complete control over your personal data and interactions with AI agents. It serves as the foundation for secure, private transactions in the agentic economy.

An AID (Agent ID) is a decentralized identity assigned to AI agents within the AIOT ecosystem. It enables verification, trust scoring, and accountability for autonomous agents performing tasks on your behalf.

AIOT implements a comprehensive trust framework including on-chain reputation systems (ERC-8004), verifiable credentials, and transparent audit trails. Every agent action is recorded and can be verified, ensuring accountability and trustworthiness.

A2A (Agent-to-Agent) is a communication protocol that enables AI agents to interact, negotiate, and collaborate with each other seamlessly. This allows for complex multi-agent workflows and efficient task completion.

x402 is a protocol for API-based cryptocurrency payments. Stripe ACP and Virtuals ACP are Agent Commerce Protocols that enable AI agents to conduct purchases and handle transactions on behalf of users through established payment infrastructure.